Would You Have Been Better Off Being Born in 1960?

In this post, I’m going to explore what lifestyle we could live if our household earned a median income in 1980 and compare it to how much our household needs to earn today to have a similar lifestyle. I will do this comparison using the San Francisco / Bay Area as well as Southeastern Michigan as the cities we live in. Here’s the order of this post:

- How much you would make if you were middle class in 1980

- What you could afford with a middle class income in Michigan or California in 1980

- How much you would make if you were middle class in California or Michigan

- What you could afford with a middle class income in Michigan or California in 2020

- Conclusions and Take-away

Income in the 1980s

If you reached your prime income earning age in 1980 and found yourself earning a “middle” class wage you would be bringing in $22000 a year. This median income range was consistent regardless of where you lived in the US (Northeast, North Central, South, or West) [1]. This may seem like a small amount today, but we have to remember that in 1980 the cost of almost everything, housing, gas, cars, college tuition, was much lower.

What you could afford with a Median Income in 1980

We’re only going to look at 5 big expenses every middle-class family thinks about: housing, transportation, food, and saving for your kids’ college education. The numbers for housing do not factor in taxes and insurance.

All of the following numbers are in 1980 dollars

- Your Home: The median home price in the Midwest-US in 1980 was $62,000. However, the interest rates back then peaked at a whopping 16% [2]. This would bring our monthly housing budget to around $840/month. If you lived on the West Coast, the median house price was around $89,000 and your housing cost would have been around $1060/month.

- Your Car: Let’s say our 1980’s self was frugal and wanted to buy a Honda Civic. A brand new 1980 model year Honda Civic ran around $4000. Gas hovered at $1.30/gallon so our transportation budget would have run us about $100/month. This assumes we buy about 9 gallons of gas every 2 weeks. [5]

- Your Food: Looking at a basket of goods ranging from spaghetti, whole wheat bread, ground beef, chicken, and eggs, our grocery bill in 1980 would run us around $120/month. [5]

- College Tuition: Let’s say you had two children around 1982. When both of your children would have turned 18 in the year 2000, 4 years of private college (tuition, room and board, and food) would run around $136,000 for two children ($68000 in tuition and fees per child). In order to save for this, you would need to put away about $3000 a year for 18 years at a return rate of 10%. [3]

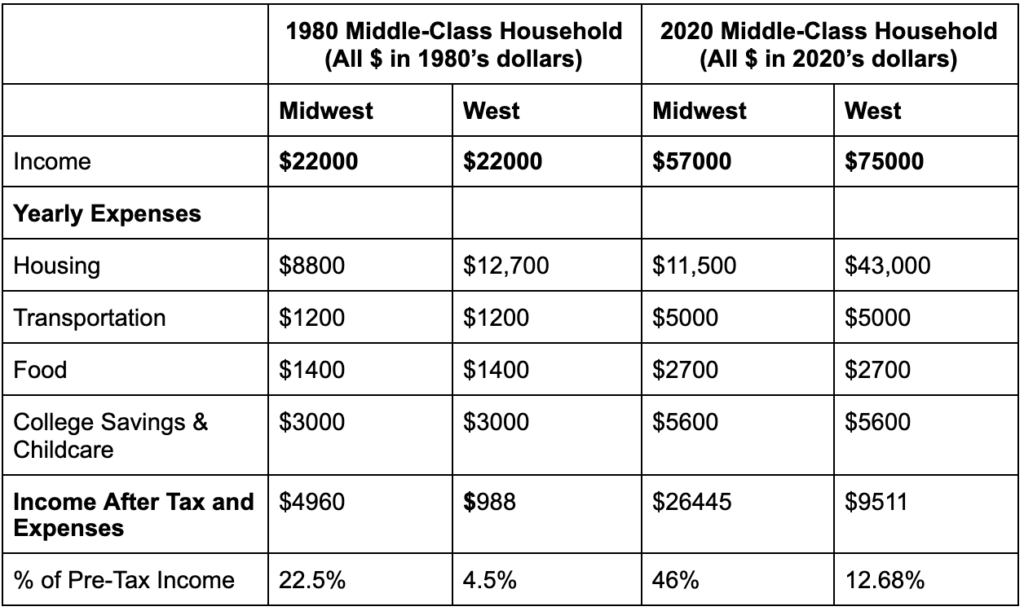

Let’s assume the effective tax rate on the median income of $21,000 was somewhere between the tax rate on the first and second quintiles: around 12%. After taxes and expenses, a middle-class household in the Midwest during 1980 would be left with around $5000 (1980’s dollars) every year in disposable income. This amounts to saving about 22% of a household’s pre-tax income. Hypothetically, this is enough to save for a third child’s college tuition and still save 10% of your pre-tax income every year.

However, a middle-class family living in California during the same time would only be left with around $1000 after taxes and expenses. This amounts to only 4.5% of their pre-tax income. Living in the midwest was much cheaper and more manageable for a middle-class family.

Income in 2020

The median income between different regions in the United States has diverged since the 1980’s – likewise, the cost for certain expenses, such as housing, has also diverged significantly between the West and the Midwest since. The median household income in California in the year 2020 hovered around $75,000 per year, whereas in the Midwest the median household income was about $57,000 per year.

What you could afford with a Median Income in 2020

Again, we’re only going to look at 5 big expenses: housing, transportation, food, child care, and saving for your kids’ college education. The numbers for housing do not factor in taxes and insurance.

All of the following numbers are in 2020 dollars

- Your Home: The median home price in California in 2020 was around $800,000. This means that for a family, the typical housing budget ran around $3600/month. If you were living in the Midwest, the median home price in 2020 was around $220,000 which would cost around $960/month. Even though home prices were much higher, the mortgage interest rates today are significantly lower compared to 1980.

- Your Car: Let’s say you bought the same brand new Honda Civic. A brand new 2020 Honda Civic would run around $20,000. With gas hovering around $4 per gallon and assuming you need to fill about 9 gallons worth every 2 weeks you would be spending about $411/month on transportation.

- Your Food: We look at the same basket of foods as in the 1980 calculation but with 2020 prices. The grocery budget in 2020 for a household would run about $230/month. This is being conservative.

- College Tuition: Just like the calculation we did for 1982, let’s assume you have two kids born around the year 2022. It’s estimated that tuition, fees, housing at a 4-year private university would run around $32,000 per child per year in the year 2020. Let’s assume those prices for college stay fixed at 2020 levels for the next 18 years until your two kids are 18 years old. This would mean you need to save about $256,000 in total for both your kids to go to college. We would need to put away about $5600 every year for 18 years at a return rate of 10% in order to save up this amount.

As with our previous example, we will use 12% as the effective tax rate for a middle-class income. After taxes and expenses, a middle-class household in the U.S. living in California during the year 2020 would be left with about $9,500 (2020 dollars) which is only 12.68% of the pre-tax income. However, a middle class living in the midwest would be left with about $26,000 after taxes and expenses, which is about 46% of their pre-tax income. Overall, this is a much better picture than I expected compared to a household living in 1980.

Conclusion and Take-away

I wanted to do this study to see if middle-class families are better or worse off today than in the 1980s. From this very rough, “back-of-napkin” calculation, it seems like overall, middle-class families are slightly better off today than in 1980. One big takeaway was the high-interest rates in the 1980’s made the principal and interest payment of an $80,000 dollar home in 1980 just as expensive as the principal and interest payment of a median midwestern home today.

There are, however, caveats to this analysis – for example:

1. The median income in 1980 was probably from just a single person in the household working, whereas today, it may be a sum of two parents working. From that standpoint, the yearly childcare costs today might be much higher. An article by the Atlantic written in 1986 suggested that “only 29 percent of married women held full-time year-round” [6]. Today’s middle-class families may also have an added burden of childcare expenses while their children are young.

2. Jobs that can pay the “Median” income come at the cost of college debt. Today, if a person wanted to earn a “median” income, they may have to put themselves in debt from college tuition.

Whether or not a family can obtain the “middle class” lifestyle of a home, two children, and being able to save for retirement and leisurely activities depends largely on where you live. It seems that much more is possible if the family is living in the Midwest, as opposed to the West Coast.

[1] – https://www.census.gov/prod/3/97pubs/97statab/construc.pdf

[2] – http://www.freddiemac.com/pmms/pmms30.html

[3] – https://educationdata.org/average-cost-of-college-by-year

[4] Money Income of Households, Families, and Persons in the United States: 1980.

[5] – https://data.bls.gov/PDQWeb/ap

[6] https://www.theatlantic.com/magazine/archive/1986/09/women-in-the-work-force/304924/