What You Can Learn From Inflation History

I became very interested in inflation when it hit record levels in 2021. If you’re curious as to what inflation is and how you can protect yourself from it, check out this post about why you shouldn’t keep your money in cash for the long term. In this blog post, I will summarize key takeaways from Jens O’ Parsson’s book, Dying of Money – Lessons of the Great German and American Inflations.

Here’s how this post is broken down:

- The Equation of Inflation

- Everything is Lagging

- Assets You Should Own During Inflationary Times

- Accepting the Inflation and the Slowed Growth

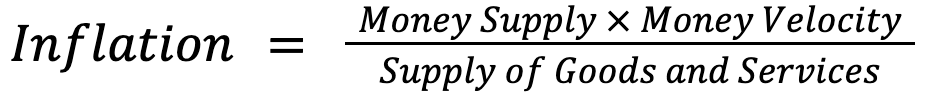

The Equation of Inflation

The general rule is that inflation is directly related to the “Money Supply” and “Money Velocity” and indirectly related to the total supply of goods and services. Inflation is money supply multiplied by money velocity and divided by the supply of goods.

- Money Supply is the total amount of money that’s in circulation. The U.S. Federal Reserve can increase or decrease the money supply by printing money. Deficit spending can also lead to an increase in the money supply.

- Money Velocity is how many times a dollar changes hands. If times are tight and people aren’t spending as much, for example during the Covid-19 Pandemic, the money velocity decreases. However, when people are looking forward to spending more on shopping, travel, etc. money changes hands more frequently and money velocity increases.

- The supply of goods and services represents the total amount of goods available for purchase. For example, if there are supply chain issues and a shortage of cars, or chips, or whatever, then the supply of goods goes down and inflation goes up.

Everything is Lagging

When it comes to inflation, changes don’t occur immediately. If any of the three variables change above, we won’t see an immediate change in inflation. Instead, the results may lag by 6 months, 1 year, maybe even 2 years. For example, in 2020 the government supplied a large fiscal stimulus and the Federal Reserve printed more money to deal with the economic fallout from Covid-19. This had the effect of increasing the money supply, however, we didn’t start to see inflation ramp up until late 2021. Likewise, in 2022 the Federal Reserve announced an increase in interest rates to rein in inflation by decreasing the money supply and slowing money velocity. We won’t immediately see inflation drop because of this.

Assets You Should Own During Inflationary Periods

“Everyone loves early inflation. The effects at the beginning of inflation are great. There is steepened money expansion, rising government spending, increasing budget deficits, booming stock markets”

Jens O’ Parsson

During the early stages of an inflationary period, asset prices soar. From the prices of homes to the prices of stocks, the value of assets will rise as more money floods into the economy searching for a home. The return of the SPY ETF in 2021 was 28%. In 2020, QQQ rose 48% and then another 27% in 2021.

At the same time, there is an increase in speculation. There were many SPACs and IPOs in 2020 and 2021. Prices of companies such as Poshmark, Wish, ThredUp, were inflated upon their debuts on the stock exchange. Many NFT digital artworks reached valuations upwards of several hundred thousand dollars. All this can be caused by excess money in the economy rather than the potential and true value of the asset.

Accepting Inflation and the Slowed Growth

Ultimately, there is nothing that can stop inflation except letting the prices reach the equilibrium point. The Federal Reserve will try and raise interest rates to reduce money velocity and will start selling bonds to reduce the total money supply but we won’t see the effects of these measures immediately because everything is lagging. Because of that, a common problem is to over-correct for inflation and drive interest rates too high. This will cause growth to slow down and the market to decline, but the worst part is since everything is lagging it will look like we are in a period of slowing growth and high inflation.

As soon as interest rates rise and the money supply is tightened, money will desert the speculative assets and seak real assets, such as land, consumer goods, and utilities. As we saw in late 2021, the stock prices of many speculative companies (such as Poshmark, Wish, ThredUp, and Affirm) came crashing down. The price of value stocks will tend to handle the shock better since everyone still needs electricity, the internet, food, and housing.