15-Year vs. 30-Year Fixed: What’s the Best Option for You

Photo by Ian Hutchinson on Unsplash

So you’ve decided to buy a home instead of renting! After taking the decisive leap to own, one of the next questions you will need to ask is “Do I go with a 30-year or 15-year loan?” In this article, I’m going to take a look at the difference between a 30-year and a 15-year fixed home loan to answer the question:

Is it better to pay off your home faster so you can get more money when you resell it to someone else, or is it better to lower your monthly payment so you can invest in the stock market?

Here’s how this article will be broken down:

- Factors to consider

- What’s the metric to decide which is best?

- Results

- Interest rates matter

- Conclusions

Factors to Consider

For this study I’m going to use the following factors for the home and the loan:

- Interest Rate: 2.5% for 30-year, 1.5% for 15-year

- Home Price: $1,200,000

- Down Payment: 20%

- Home Appreciation Rate: 4%

The average home in the US will appreciate at an average rate of 4% a year

These are some other factors to consider:

- Stock Market Annual Appreciation: 8.00%

- Savings Efficiency: 95%

- Long Term Capital Gains Tax: 15%

The average 30-year return for the S&P 500 adjusted for inflation is 8.00%. Some may argue that homes in certain areas, such as California’s Bay Area, appreciate much faster than the national average. Although that’s true, I believe home prices in the bay area are mostly tied to equity prices. For example, in 2021 homes in San Mateo went up 11%. Palo Alto went up 14%. Fremont went up 25%. However, if you look at equity returns at the same time, the S&P 500 went up 18% in 2020 and has been up 18% in 2021. The NASDAQ, which is composed mostly of tech companies at this point, went up 42% in just 2020. We can’t assume that these double-digit returns will continue for homes or equities so we will use the average.

What’s the metric to decide which is best?

We’re going to use what I call “The Net Cash Difference”: after selling the home, which option leaves you with more cash overall?

When you get a 30-year loan, your payments are spread out over a longer time period as compared to a 15-year loan so it’s going to take longer to pay off your home. However, the benefit of a 30-year loan is lower monthly payments compared to a 15-year loan. Even though you aren’t building equity in your home as fast with a 30-year loan, you’ll have more money to invest in other assets, such as stocks.

With a 15-year loan, you are paying off your loan and earning principal in your home faster. When you go to sell the home, you’ll have accumulated more principal and have less remaining on the loan, therefore, you get more cashback after selling.

Cash After Selling = “Sale Price of Home” – “Amount left on the loan”

To determine which loan type is better, we need to see which scenario yields us more cash after selling our home and our stocks.

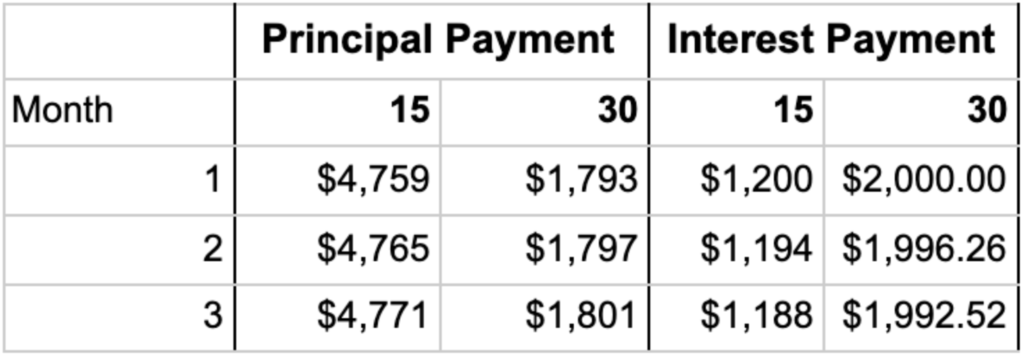

Using the factors (home price, interest rate, down payment amount) mentioned above, here are the first couple monthly payments broken down for a 30-year loan vs. a 15-year loan:

In our scenario, you will be paying $4759 in principal and $1200 in interest on a 15-year loan for a total monthly payment of $5,959. Whereas for a 30-year loan you will be paying $1793 in principal and $2000 in interest for a total monthly payment of $3793. For a 30-year loan, you have about $2200 more a month to invest in stocks.

However, in this scenario, we are going to assume that you’re only going to save 95% of that extra $2200 in cash – with extra money lying around you may be tempted to splurge a little on dining, groceries, or travel. We may end up increasing discretionary spending rather than investing all of the extra cash, so our “Savings Efficiency” is 95%.

Finally, we’re going to use a long-term capital gains tax of 15% for our stocks and home sale. Keep in mind that for our primary residence home, meaning we’ve lived in it as a primary residence for at least 2 years, we are exempt from capital gains tax up to $500,00 for a married couple.

Results

In the chart below, the two curves represent the total cash you will have after selling your home and all of your stocks in a 15-year loan versus a 30-year loan scenario. Using the factors above, we can see that a 15-year loan makes the most sense if you plan on selling your home within the first 100 months (about 8 years) of ownership. If you plan on living in your home for more than 8 years, it makes more sense to go with a longer loan because a lower mortgage payment means that you will have more to invest, and over a longer period of time those investments will outpace the growth of the home value.

30-year vs 15-year fixed with a 95% savings efficiency

Let’s say that you have a lower “Savings Efficiency” rate of 85%, meaning you only save 85% of the extra cash you have with a lower mortgage payment. In that case, you will need to own the home for at least 11 years for a 30-year loan to be more advantageous than a 15-year loan.

30-year vs 15-year fixed 85% savings efficiency

It’s no surprise that the longer you stay investing in the stock market, and the more disciplined of a saver you are, the more you stand to gain by going with a lower monthly payment and investing the extra in the stock market. However, if you’re not confident in your savings efficiency, or if you’re not sure if the home you are purchasing is your forever home, it may be worth considering a 15-year loan instead.

Interest rates matter

One important thing to note is that interest rates also play a big part in what type of loan is best. In today’s climate, Q1-Q2 of 2021, interest rates are extremely low. Let’s say interest rates go up to 6% for a 30-year fixed loan and then 4.5% for a 15-year fixed loan. Keeping all the other factors (property price, appreciation rates, tax rates, stock growth rate) the same, the 30-year home loan will never be worth it compared to the 15-year loan even if our “Savings Efficiency” is 95%. This is shown in the graph below.

30-year (6% interest rate) vs 15-year (4.5% interest rate) loan with 95% savings efficiency

Conclusion

In conclusion, if you plan to live in your home for longer than 8-10 years and you are confident that you can diligently invest a significant portion of your savings for a long-term period, it’s better to go with a 30-year loan. If you think you’re probably going to move in a couple of years, and you think property prices may increase rapidly in the short term it’s good to go with a 15-year loan. Also, if interest rates are starting to climb to 6% or higher, then it would be better to do a 15-year loan over a 30-year loan regardless of how long you plan to live in the home.

Before deciding on either type of loan, it’s best to consider how much of a monthly mortgage payment you can afford. Never commit to a loan that’s greater than the amount you can pay for after factoring in your current and future living expenses.